Monday - Friday

09:00 AM - 05:30 PM

Understanding VAT can be complex, especially with various regulations affecting different types of businesses. At Divine Accountants, we provide the best VAT services to help you navigate these complexities with ease. Our comprehensive VAT solutions include registration, compliance, and strategic advice, tailored to your business needs.

Divine Accountants can assist in assessing whether your business needs to register for VAT. We're well aware of the complexities involved in the registration process, so we can handle the registration with HMRC on your behalf. We'll handle all the necessary checks and ensure a swift registration process. If you're considering voluntary registration, we can also evaluate whether it would be financially advantageous for your business in the long run and contribute to its growth.

We'll handle your VAT registration and review process, addressing all your concerns and conducting essential checks. Divine Accountants will also evaluate if a specific VAT scheme is suitable for your situation. Being VAT registered through us signifies trust between clients and vendors, enhancing credibility. This registration can also help businesses save on overhead costs by reclaiming paid VAT, which can then be reinvested into other operations.

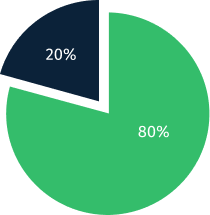

VAT reporting is required on a monthly, quarterly, or annual basis, depending on your business’s VAT scheme. Your VAT return summarizes the VAT collected on sales and the VAT spent on purchases. If the VAT collected exceeds the VAT spent, you owe HMRC the difference. Conversely, if you’ve incurred more VAT than collected, HMRC will reimburse the difference

Divine Accountants offers VAT health check services for your business, designed to identify potential issues before they come to the attention of tax authorities. We've streamlined the process for your convenience.

Divine Accountants assists you in avoiding penalties due to inaccuracies. This service offers you the opportunity to assess risks by reviewing your current processes and practices. Undertaking a Health Check service demonstrates to HMRC that you are diligent in your approach to VAT. Divine Accountants provides guidance throughout to ensure all necessary steps are properly executed.

Obtaining help with VAT returns from Divine Accountants is simple. Fill out our easy online quotation form with basic details about your business. We’ll provide a personalized quote outlining our services, timelines, and costs, ensuring a confidential and tailored approach to your VAT needs

Divine Accountants provides the best VAT services with a focus on accuracy and compliance. Our team’s extensive experience with VAT regulations, including VAT for commercial property, VAT on business rates, and services for VAT-registered charities, ensures your business remains compliant and efficient. Trust us to manage your VAT needs with professionalism and expertise

Get the best VAT services with Divine Accountants. We specialize in VAT registration, compliance, and advice, including VAT for commercial property, VAT on business rates, and more. Expert help for sole traders and VAT-registered charities.

VAT (Value Added Tax) is a tax applied to goods and services at each stage of production or sale. Businesses must charge VAT on their sales and can reclaim VAT on their purchases. VAT reporting is required periodically—monthly, quarterly, or annually—depending on your VAT scheme. If the VAT you collect on sales exceeds the VAT you spend on purchases, you owe HMRCthe difference. If you’ve spent more VAT than you’ve collected, HMRC will reimburse the excess.

Sole traders must pay VAT if their taxable turnover exceeds the VAT registration threshold set by HMRC. If your turnover is below this threshold, you may choose to voluntarily register for VAT. VAT registration allows you to reclaim VAT on business expenses but requires you to charge VAT on your sales and adhere to VAT regulations

Divine Accountants provides expert guidance on VAT issues related to commercial property. We help you understand how VAT applies to your property transactions, manage VAT on property purchases and sales, and ensure compliance with relevant VAT regulations. Our services also include assistance with VAT registration and claims for VAT on property expenses.

The VAT annual accounting scheme allows businesses to submit one VAT return per year rather than quarterly or monthly. This scheme is suitable for businesses with an annual taxable turnover under a specific limit. It simplifies VAT reporting and can improve cash flow. Divine Accountants can assess if this scheme is appropriate for your business and assist with the registration and compliance process.